The Open-Source Data Backbone for Private Market Funds

Stop relying on fragile spreadsheets and vendor black boxes. Connect your systems, automate reporting, and plug AI models on a clean data foundation.

THE PROBLEM

Disconnected Data Is Costing You Time, Deals, and Confidence

From Excel chaos to system silos and vendor lock-in — too many teams rely on fragile workflows that slow reporting, obscure insights, and limit decision-making.

🧩

Siloed Systems

Your CRM, fund admin portal, ESG tracker, and more all operate in isolation — creating gaps, duplicates, and inconsistencies.

📉

Excel Chaos

Data lives in spreadsheets and exports — with no single source of truth. Teams waste time reconciling versions instead of acting with confidence.

🕰️

Slow, Manual Reporting

Quarterly reports, ESG disclosures, and LP updates take days — driven by spreadsheets, screenshots, and repeated copy-paste.

🔒

Vendor Lock-In

Legacy platforms charge steep fees, restrict access, and make it costly just to extract your own information.

⚠️

Hidden Audit Risk

Manual processes lead to errors, outdated data, and untraceable changes — making compliance slow and stressful.

❌

Missed Opportunities

Without clean, real-time data, you can’t respond quickly to changes or move capital with confidence.

“Spreadsheets are the most dangerous software in the planet”

— FORBES

Our solution

Build the Data Backbone Your Fund Needs

Connect, unify, and scale your fund’s intelligence layer — without switching systems.

🔗

Unify Your Data

Connect and reconcile your CRM, fund admin, risk, ESG data and more into a unified, finance-native warehouse.

📊

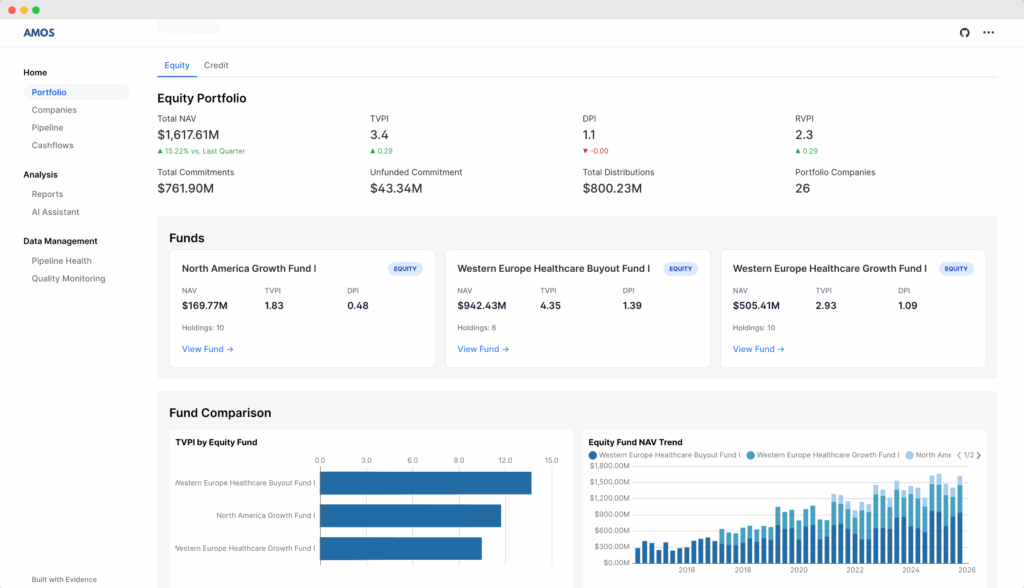

See in Real Time

Power live dashboards and analytics to track performance, forecast cashflows, and move capital faster.

🧠

Ready for AI

Clean, structured inputs mean you can power copilots, automate insights, and deploy LLMs confidently.

✅

Compliance Made Easy

Turn structured data into LP updates, ESG disclosures, and regulatory reports — consistently and automatically.

🌐

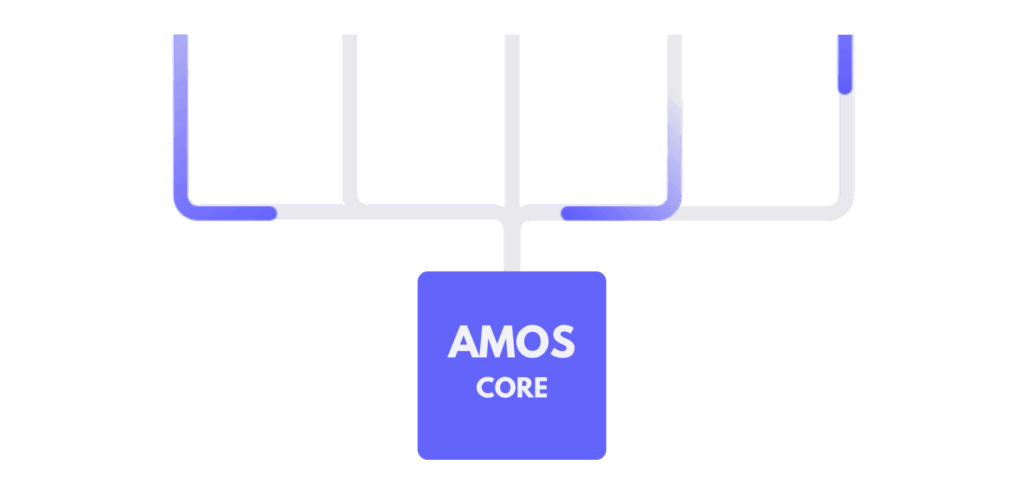

Open, Flexible Architecture

AMOS Core is open source and modular — giving you full data ownership, transparency, and extensibility.

🚀

Fast Setup

Start small, connect what you already use, and scale gradually — without overhauling your existing tools.

“It used to take us days to prep a quarterly report. We now do it in hours — and actually trust the numbers.”

— COO, Private Equity Fund

Open Source

Built to Stay Open, Evolve, and Scale

Open source means transparency, flexibility, and long-term control of your data.

✅ No Vendor Lock-In

Own your architecture, adapt it freely, and stay in control as your needs evolve.

✅ Transparent

Open-source logic promotes shared standards across systems and teams — simplifying integration, audits, and collaboration.

✅ Future-Proof

Built to evolve: benefit from a growing ecosystem of improvements, upgrades, and contributions — without rework or reimplementation.

Managed Deployments & Customization

Love the open-source platform but don’t have the engineering resources?

We can build and manage your instance for you.

① Audit

We assess your stack, workflows, and pain points

Together we map out your systems, bottlenecks, and what a better data foundation would unlock.

② Integration

We build your data layer using best-in-class tools

We integrate your sources into a unified warehouse — structured, reconciled, and finance-native.

③ Activation

You get 360° analytics dashboards, APIs, and documentation

Your team can start reporting, analyzing, and automating — all with ownership and room to grow.

BUILT BY PRACTITIONERS

Our Team

We Combine Frontline Fund Ops Experience with Engineering and Policy Expertise.

📈

Finance-First Engineers

Data engineers who understand fund operations, LP reporting, and investment workflows. We speak your language because we’ve been in your shoes.

🏛️

Senior Private Markets Professionals

10+ years heading investment and portfolio teams, managing the exact challenges you face daily. We know the pain points because we’ve lived them.

⚖️

Policy & Regulatory Experts

Public policy professionals with US administration and European Union experience. We understand compliance, ESG, and regulatory landscapes.